Table of Content

With a few inputs, you can determine how much mortgage you may be comfortable with and the potential price range of your future home. Knowing your total household income, how much youâve saved for a down payment, and your monthly expenses , plus new expenses youâd take on , you can get a reasonable estimate. Learn more about factors that can affect your mortgage affordability. The results are calculated and generated based on the accuracy and completeness of the data and information you have entered and provide an estimate only. The results are intended for illustrative and general information purposes only, and do not constitute, nor should they be relied upon as, financial or other advice. The interest rate shown is calculated either semi-annually not in advance for fixed interest rate mortgages or monthly not in advance for variable interest rate mortgages.

Before that, she covered macro and central banks for Investor's Business Daily, and municipal bonds for Debtwire. It’s important to keep in mind that any HELOC is secured by your home, similar to a mortgage. That means failure to make timely repayments could put you in jeopardy of losing the property.

Real estate taxes

Although not a required step, it is helpful as it can give you a clearer picture of how much house you may be able to afford. In addition, the validity of the results youll get from this mortgage prequalification calculator will only be as good as the information you input. If you inflate any information, like your annual income or your credit score range, you may get a higher loan amount, only to get a smaller pre-approval amount from an actual mortgage lender.

This is appealing to most consumers because it ensures monthly payments stay within an affordable range. It also follows a traditional amortization schedule that shows the exact number of payments you must make within the agreed term. For example, with a 30-year fixed-rate mortgage, your payments are spread throughout 360 monthly payments. Your loan will surely be paid within 30 years as long as you pay as scheduled. For those who are self-employed, lenders confirm your income by reviewing tax return transcripts from the IRS.

Your Total Payment (All items):

Correct any errors on your credit report, which could help to raise your credit score. The lender will analyze your credit report for any red flags, such as late or missed payments or charged-off debt. Even if you are deemed to have bad credit, there are ways to still get pre-approved for a mortgage.Decrease your overall debt and improve your debt-to-income ratio. In general, a debt-to-income ratio of 36 percent or less is preferable 43 percent is the maximum ratio allowed. Use our debt-to-income calculator to determine your debt-to-income ratio.Increase your down payment amount in order to qualify for a larger loan. Another important factor lenders watch out for is your debt-to-income ratio .

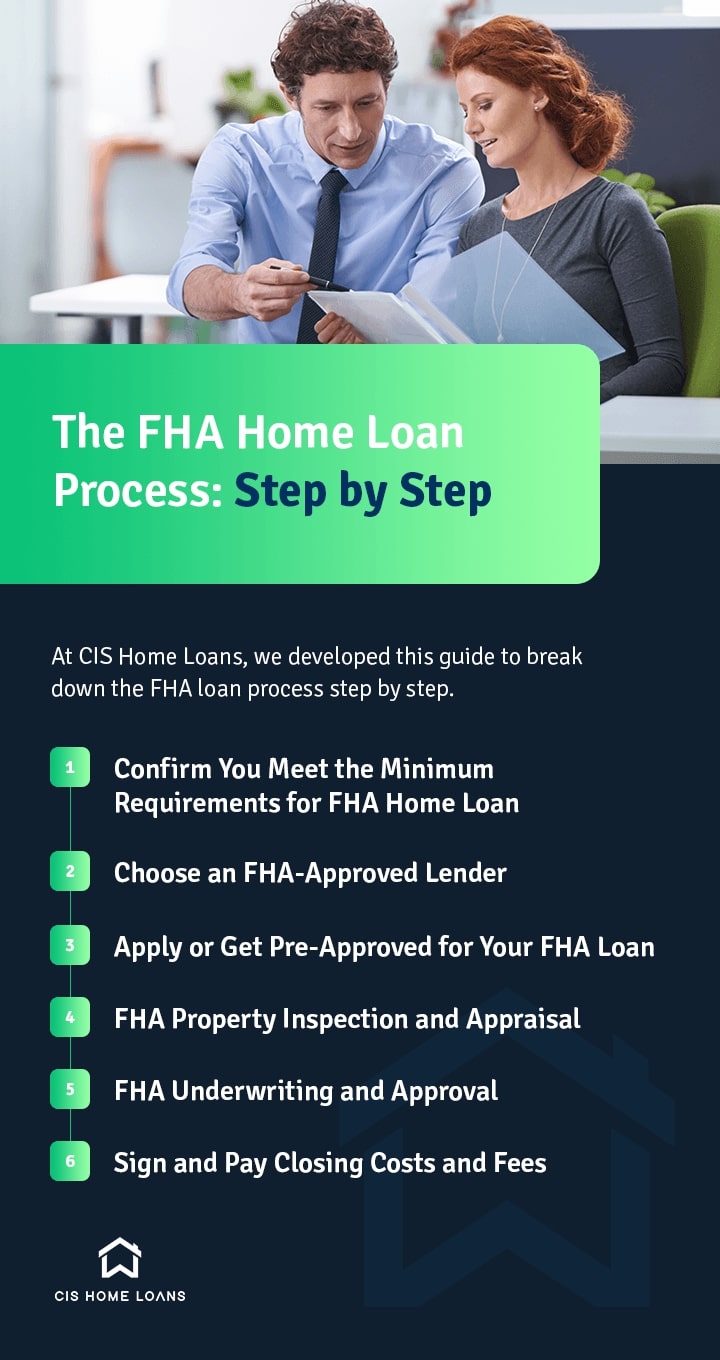

Our affordable lending options, including FHA loans and VA loans, help make homeownership possible. Check out our affordability calculator, and look for homebuyer grants in your area. Visit our mortgage education center for helpful tips and information. And from applying for a loan to managing your mortgage, Chase MyHome has you covered.

Current Local Mortgage Rates

But if you earned significantly more in one year than the other, the lender may opt for the year's average with lower earnings. We're not including monthly liabilities in estimating the income you need for a $325,000 home. To include liabilities and determine what you can afford, use the calculator above. This estimate is for an individual without other expenses, and your situation may differ.

Form 4506 is used to request a copy of your tax return directly from the IRS, thus preventing you from submitting falsified returns to the lender. It costs $43 per return, but you may be able to request Form 4506-T for free. Form 8821 authorizes your lender to go to an IRS office and examine the forms you designate for the years you specify, free of charge. The mortgage pre-approval calculator is self-explanatory, but heres a general overview. You are more likely to get a better interest rate by comparing terms offered by multiple lenders, and it might be illuminating to see the loan amounts different lenders will qualify you for. And the impact on your budget may seem to be a stretch, particularly in the beginning.

Next, your lender will figure out what sort of interest rate you can qualify for, because that's one of the most important factors affecting your monthly payment amount. Lenders will perform a credit check when you apply for a HELOC, just like for any credit product, and that will reduce your credit score temporarily. But if you make repayments on a timely basis, your credit score will recover quickly. Many borrowers use them for home upgrades or repairs, but education costs or other large purchases are also allowed. Don’t forget that the variable interest rate on a HELOC may mean that other forms of financing make more sense. Make a mortgage payment, get info on your escrow, submit an insurance claim, request a payoff quote or sign in to your account.

In doing this, the lender assesses how risky it is to take you on as a borrower. During the review process, your lender will review your financial information, especially your credit profile and income. Your credit score, income and debt-to-income ratio must meet the lender’s minimum requirements to qualify for a personal loan. The simple interest rate represents the annual cost of borrowing funds. The annual interest rate is not to be confused with the annual percentage rate .

We encourage users to contact their lawyers, credit counselors, lenders, and housing counselors. If you calculate based on income, the calculator will take information about your financial health and loan preferences, combined with projected taxes andinsurance, to provide an estimate. Just because you get approved for a large sum doesn’t mean you can afford a house in that price range. Once you find a house you love, you shouldcalculate your monthly payment in order to get a better idea of how much you’ll owe each month prior to taking on the commitment. For example, conventional loans usually have stricter DTI requirements than FHA loans, insured by the Federal Housing Administration.

Gather all necessary documents that show your proof of employment prior to applying for a better chance at getting approved. Before you start looking at real estate and shopping around for the right lender, it’s important to take these steps to improve your chances of becoming a homeowner without breaking the bank. MoneyGeek’s guide outlines our top tips and recommendations for getting approved for a personal loan. IMPORTANT. The affordability calculator provides only a general estimate, is intended for initial information purposes only, and your use of the affordability calculator is subject to our Terms of Use. Debt payments are payments you make to pay back the money you borrowed. A conventional loan is a type of mortgage that is not insured or guaranteed by the government.

In order for the approval process to be completed, your lender will require the purchase agreement as well as the MLS listing. The value of the property youve agreed to purchase will be assessed by an appraiser appointed by the lender to make sure that the price you agreed to pay is on par with what the home is actually worth. A lender will generally start by asking for some basic information about you and your financial history. If you have a co-borrower, the lender will also need this information about them. Generally, a lender will then request your Social Security number and permission to pull your required credit report . Please note that each lender has its own standards and processes for determining whether to grant a pre-approval letter.

While prequalification doesn’t give you a loan commitment or a guarantee, it’s a good first step to see the amount and type of loan a lender could offer you. Working out a monthly household budget can help tell you how much you should borrow. After all, you don’t want to stretch your budget to its limit in order to accommodate a loan. This means you can hold on to more of your savings, which can come in handy for the unexpected costs of homeownership.

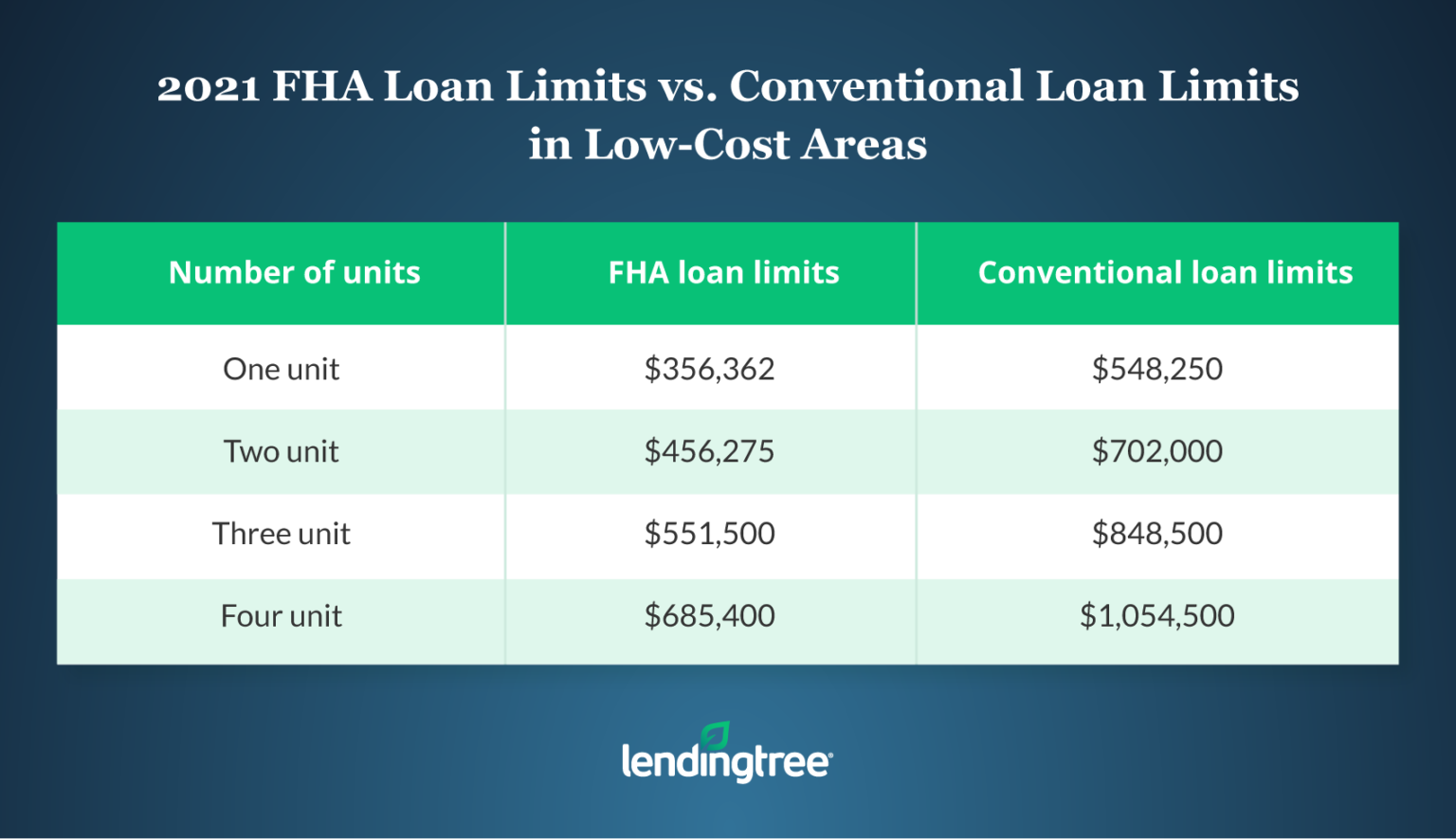

When qualifying for a mortgage, besides having adequate income, it’s important to have a good credit score. It’s also worth paying 20% down payment to lower your monthly payments and avoid the added cost of PMI on a conventional loan. Improving these primary financial factors help increase your chances of qualifying for a mortgage. FHA loans are restricted to a maximum loan size depending on the location of the property.

Realtor.com® can help you make the best home finance decision with our useful rent vs. buy calculator, which helps you estimate the difference between renting a property or buying a home over time. Before you start searching for the perfect home loan, find the best mortgage rates and loans at realtor.com®. For additional resources and advice, browse our extensive library of finance articles and get the information needed about mortgage rates, mortgage lenders, credit scores, home insurance and refinance. If your debt payments are less than 36 percent of your pre-tax income, you're typically in good shape. Some additional factors include your desired down payment, as well as your other regular monthly expenses.

No comments:

Post a Comment